BCFI Self-RegulatoryOrganization (SRO): Proposed Draft Framework

BCFI has now over 50+ Corporate BCs (CBCs) as members and 1Million + unique Customer Service Points (CSPs). There is a need for BCFI to set up an independent Self-RegulatoryOrganization housed in BCFI, that can work on establishing standards for business correspondent and digital payments service providers, monitor their business processes and activities, customer grievances, and compliance with the code of conduct.An independent unit housed in BCFI is proposed to be formed to carry out SRO activities. All the activities envisaged for the SRO can be taken up by the new unit. This unit is proposed to be be called “Standards and Compliance Council” (SCC). The document below describes brief process and select documents that can be made available for public viewing.

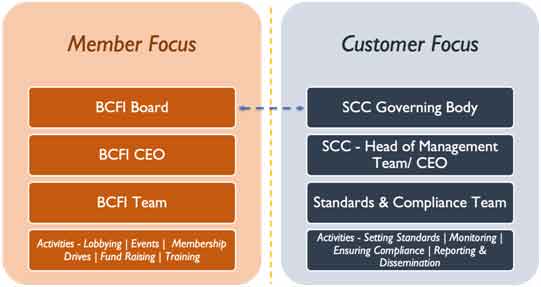

Governance and Management Structure of the SCC

SCC will be a self-regulatory organization and will be completely independent of the lobbying activities carried out by BCFI. The SCC head will report directly to the Governing Body to ensure segregation of activities and independence.

- SCC membership for BCFI members would be free (and mandatory).

- New members would either be core members (CBCs) or associate members (payment service providers, fintech, donors, other agencies).

- BCFI activities will be governed by the existing Board (and elections etc. will take place as usual).

- A separate independent Governing Body will govern the activities of SCC.

- The BCFI Board will delegate all activities falling in the realm of standard setting, monitoring, compliance, customer care, data collection, and data reporting to the SCC Governing Board. Thereafter, BCFI Board and SCC Governing Body will work independently. This will ensure the independence and transparency in its work.

Best Business Practices for members

These Best Business Practices articulate the standards of care and customer service that customers will expect to receive when doing business with a BC member.

| Fair and respectful treatment of customers | Members will treat their customers fairly and respectfully at all stages of the relationship. They will not discriminate against any customer because of their religion, caste, colour, age, sex, and place of birth or residence. Members will ensure adequate safeguards to detect and correct corruption and abusive treatment. Members will also take care that special attention is given to the needs of vulnerable persons and groups. |

| Transparency | Members will communicate clearly and provide timely information in a manner and language that customers can understand, so that customers can make informed decisions. Communication will include information about the rights and responsibilities of each party, including the mechanism for either party to end the banking relationship, as well as details of fees, pricing and any potential penalties that the customer may incur. For illiterate customers, members will ensure a mechanism to verbally explain the terms and conditions, details of product and/or service, and all relevant information. The concerned employee/agent will get a declaration to this effect signed by the customers or get their thumb impression on the declaration mentioning that they have been explained these details. This declaration will form a part of the customer enrolment file that is created electronically or in physical form. |

| Behaviour and work ethic | Members will ensure that their employees and agents work in a professional manner for the benefit of customers during their relationship with the member organization, and even after the relation has formally ended, if customers need any help with documents, transaction details etc. If there is a dispute regarding a transaction, failed transaction, difference in the interpretation of terms & conditions, etc., and a customer is upset and/or shouts or misbehaves with the agent or their staff or member, the concerned agent, their staff, and member’s employee will treat the customer with courtesy, will not shout back and mistreat the customer. They will try to resolve the matter with documentary evidence and logical explanation. If the customer is still dissatisfied, they will help the customer raise a complaint through proper official channels and keep him/her informed about the progress of their complaint. |

| Appropriate product design and delivery | Members will take adequate care to design delivery channels that do not cause any harm to customers. Delivery channels will be designed with customers’ characteristics, ease of access, and convenience of doing transactions, taken into account. |

| Security and Privacy of customer data | The security and privacy of individual customer data will be respected in accordance with local laws and regulations and will only be used for purposes specified when the information is collected, unless otherwise agreed with the customer. Customer consent for collection, storage, and use of data will be sought from each customer before any data is collected. |

| Mechanisms for complaint resolution | Members will have in place mechanisms for timely and responsive resolution of complaints and problems of their customers. The information and feedback collected during the process will be used by them to improve products and services. |

| Display of fees and charges at agent point | Members will ensure that fees and charges for services and products offered by the member are prominently displayed at each agent point in at least two languages, one of those being vernacular and the other either Hindi or English depending on the prevalence of the language. The collaterals will be legible from a distance, ideally from the entry point of the premises/outlet. These will be placed in the waiting area, and behind the counter/desk where the transactions are conducted. Take-away booklets/pamphlets/brochures will be made available to people who ask for them. |

| Ease of Identification | Members will take appropriate measures to ensure that the agent point and the appointed agent is identifiable. Members will ensure that the agent point will display approved branding materials, especially the certificate of appointment by the member, principal banks’ link branch address and contact details of the manager who is responsible for the particular agent point, etc. Members will also ensure that the agents wear their ID badges during all business hours. |

| Appropriate Agent Disengagement Process | Members will have in place a well-defined agent disengagement process, which will include steps to be taken to inform customers, notice at the old agent location, address of nearest agent and ATM etc. |

Following additional documents are finalized and available with CEO (Designate) - SRO & Head, BCFI for review by members:

- Data & Confidentiality Policy

- Governance & Management Structure

- Fraud Reporting & Management

- Customer Grievance Redressal Policy

- Whistleblower Policy

- Code Of Conduct

- Member Empanelment & Disengagement Process

- Rights and Responsibilities – Members and Associates